Consequences of Fraudulent Claims for Employee Retention credit (ERC)

Introduction

The Internal Revenue Service (IRS) has been cracking down on fraudulent claims for the Employee Retention Credit (ERC). As businesses continue to struggle amidst the ongoing pandemic, the ERC provides a lifeline by offering tax credits to eligible employers. However, with the rise in fraudulent activity, the IRS is intensifying its efforts to ensure that only legitimate claims are approved.

What is the Employee Retention Credit?

The Employee Retention Credit is a tax credit introduced as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. It is designed to help businesses retain employees during the economic downturn caused by the COVID-19 pandemic. Eligible employers can claim a refundable tax credit against certain employment taxes for qualified wages paid to their employees.

The Rise in Fraudulent Claims

Unfortunately, some unscrupulous individuals and businesses have taken advantage of the ERC by submitting fraudulent claims. These fraudulent claims not only drain valuable resources from the government but also undermine the integrity of the relief program. As a result, the IRS is actively targeting and investigating suspicious claims to protect the system and ensure that funds are distributed to those who truly need them.

IRS Enforcement Actions

The IRS has implemented several enforcement actions to combat fraudulent ERC claims. These actions include increased scrutiny of claims, data analysis to identify patterns of fraudulent activity, and collaboration with other government agencies to share information and resources. The IRS is also conducting audits and investigations to hold those responsible for fraudulent claims accountable.

Tips to Avoid Fraudulent Claims

As an employer, it is crucial to ensure that your ERC claims are legitimate and accurate. Here are some tips to help you avoid inadvertently making fraudulent claims:

- Understand the eligibility criteria for the ERC and ensure that your business meets all the requirements.

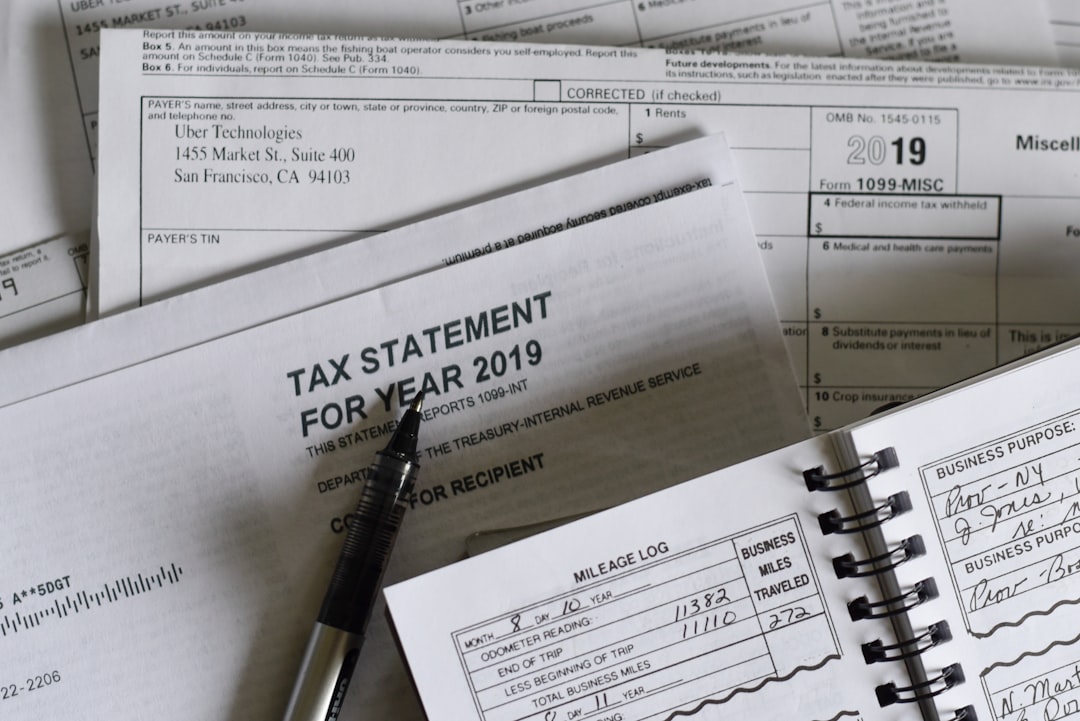

- Maintain detailed records and documentation to support your claims, including payroll records and evidence of the impact of COVID-19 on your business.

- Double-check your calculations and consult with a tax professional if you have any doubts or questions.

- Stay updated on the latest guidance and announcements from the IRS regarding the ERC.

Consequences of Fraudulent Claims

Filing fraudulent ERC claims can have severe consequences for both individuals and businesses. The penalties for fraudulent activity can include criminal charges, fines, and imprisonment. In addition, individuals and businesses found guilty of fraud may be required to repay any wrongfully claimed credits and face additional civil penalties.

Conclusion

The IRS is committed to ensuring that the Employee Retention Credit reaches those who truly need it. By intensifying their efforts to combat fraudulent claims, the IRS aims to protect the integrity of the relief program and preserve valuable resources. As an employer, it is essential to understand the eligibility criteria, maintain accurate records, and avoid any actions that could be perceived as fraudulent. By doing so, you can contribute to the fair distribution of the Employee Retention Credit and help your business navigate these challenging times.